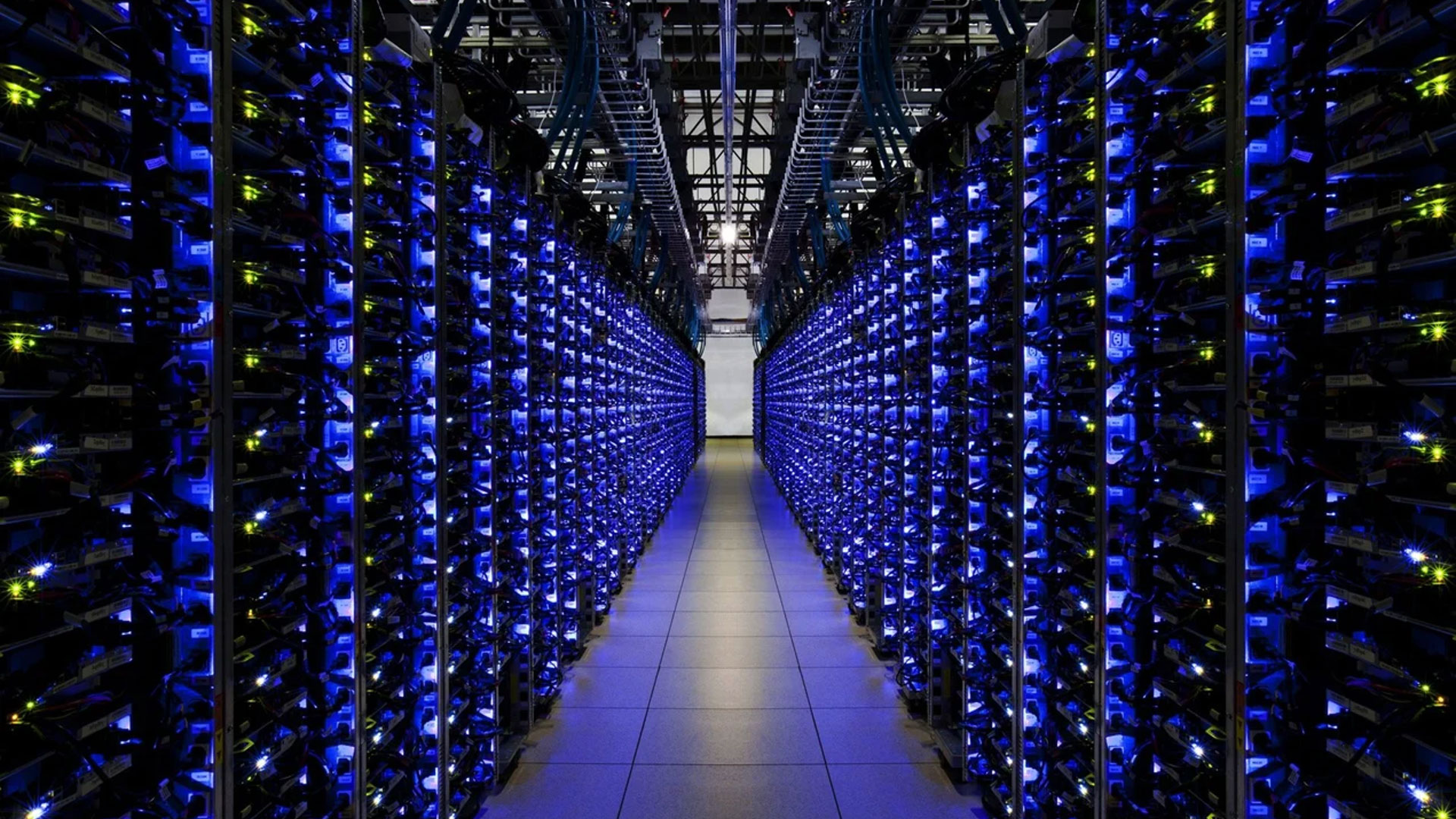

In the evolving landscape of technology, data centers stand as the backbone of our digital infrastructure, powering everything from social media platforms to e-commerce giants. Yet, this critical infrastructure faces significant challenges in terms of energy consumption and sustainability. Enter microgrid systems providing energy as a service, a new approach that can transform the way data centers operate and enable them to thrive in the modern world.

The Rise of Data Centers and Their Energy Woes

Data centers are at the heart of the digital age, storing and processing the vast amounts of data that fuel our interconnected world. However, this rapid growth comes with a hefty energy price tag. According to recent estimates, data centers consume about 1% of the world’s total electricity, a figure projected to rise as our reliance on digital services continues to grow.

Traditional data centers rely heavily on the grid for their energy needs, which poses several challenges. First, they are susceptible to power outages and grid failures, which can have catastrophic consequences in terms of data loss and downtime. Second, the reliance on fossil fuels for electricity generation contributes to carbon emissions and environmental degradation, making it increasingly untenable in an era of heightened climate awareness.

The Promise of Microgrids

Microgrids offer a compelling solution to these challenges by providing data centers with a more resilient, efficient, and sustainable energy infrastructure. At its core, a microgrid is the integration of distributed energy resources and advanced control technologies to create localized grids that can operate independently or in conjunction with the main power grid.

Resilience and Reliability

One of the key benefits of microgrids for data centers is enhanced resilience and reliability. By diversifying their energy sources and incorporating energy storage systems, data centers can ensure uninterrupted operation even in the event of grid outages or disruptions. This is particularly crucial for mission-critical applications where downtime can result in significant financial losses or damage to reputation.

Energy as a Service = Cost Savings

The Energy as a Service (EaaS) model means that businesses don’t have to invest in expensive energy infrastructure. The EaaS provider owns the equipment, hardware and software and sells power to the business at reduced rates compared to their traditional utility. By harnessing renewable energy sources, such as solar and wind, data centers can reduce their reliance on grid electricity, thereby lowering their energy bills and mitigating the impact of fluctuating energy prices.

Environmental Sustainability

Perhaps most importantly, microgrids enable data centers to make significant strides towards environmental sustainability. By transitioning to renewable energy sources and reducing their carbon footprint, data centers can play a crucial role in combating climate change and promoting a more sustainable future. This not only aligns with corporate social responsibility goals but also positions data centers as leaders in the transition to a low-carbon economy.

Conclusion

Microgrids hold immense promise for revolutionizing the way data centers operate and thrive in the digital age. By providing enhanced resilience, cost savings, and environmental sustainability, they offer a compelling solution to the energy challenges facing data centers today. As the world becomes increasingly interconnected and data-driven, embracing microgrids and EaaS will be essential for data centers to remain competitive, resilient, and sustainable in the years to come.